Unraveling the Tapestry of Urban Tots Share Price: Latest News and Updates

The Enigmatic Swing: A Closer Look

In the ever-evolving landscape of the stock market, few companies have captured the imagination of investors quite like Urban Tots, the trendsetting retailer of premium children’s apparel and accessories. Over the past year, the Urban Tots Share Price has embarked on a rollercoaster ride, leaving analysts and shareholders alike scratching their heads in bewilderment. This article delves deep into the intricate tapestry woven by Urban Tots Share Price fluctuating fortunes, unraveling the potential factors that have contributed to its enigmatic share price swing. Deepak Houseware and Toys (DH&T) is a leading manufacturer and retailer of innovative playthings for children. The company’s diverse product portfolio encompasses plastic toys, electronic toys, and role-play items, catering to the ever-evolving interests and imaginations of young minds.

About Urban Tots

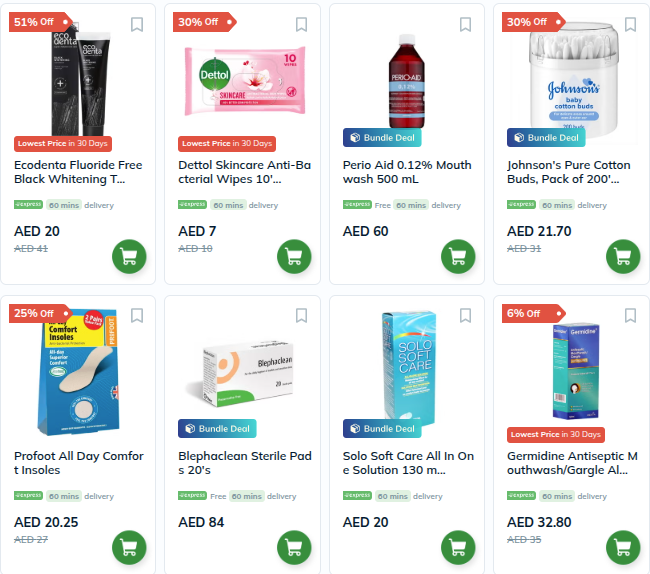

DH&T’s products grace the shelves of renowned retail outlets such as Hamleys, FirstCry, DMart, and Reliance Retail, ensuring widespread accessibility for families across the nation. Additionally, the company has embraced the digital age, offering its wares on popular e-commerce platforms like Flipkart and Amazon, providing convenience and choice to modern-day consumers.

Driven by a spirit of innovation, DH&T is poised to venture into uncharted territories by introducing metallic and wooden toys – a first-of-its-kind endeavor in the Indian market. To support this pioneering initiative, the company has established a dedicated wooden toys department within its state-of-the-art manufacturing facility, housing a total of 60 cutting-edge machines.

In recognition of its commitment to fostering employment opportunities, DH&T’s retail arm, Urban Tots, has been selected by the government of Rajasthan to receive a 5% subsidy on interest payments under the esteemed DIC scheme. This endorsement not only underscores the company’s economic contributions but also aligns with the state’s vision of promoting inclusive growth.

Despite the challenges posed by the COVID-19 pandemic, DH&T embarked on its journey in August 2021, defying adversity with unwavering determination. Within a mere nine months of operations, the company has achieved remarkable success, generating a staggering revenue of Rs. 16 crore in the financial year 2022 – a testament to its agility and market relevance just 20 months after its inception.

Headquartered in Jaipur and incorporated on August 6, 2020, DH&T has swiftly established itself as a trailblazer in the realm of children’s toys, blending innovation, quality, and a commitment to nurturing the boundless imaginations of the young generation.

Riding the Wave of Pandemic-Fueled Demand

The onset of the COVID-19 pandemic brought about seismic shifts in consumer behavior, with parents increasingly seeking solace in online shopping for their little ones. Urban Tots, with its meticulously curated collection and seamless e-commerce experience, found itself riding the crest of this wave. As families prioritized quality over quantity, the brand’s premium positioning and commitment to sustainability resonated strongly with its target demographic.

Initially, Urban Tots’ share price soared, reflecting the market’s optimism about the company’s ability to capitalize on the surge in demand. However, as the pandemic’s grip loosened and brick-and-mortar stores reopened, the wave of online shopping began to subside, casting a shadow of uncertainty over the company’s future prospects.

The Shift Towards Conscious Consumerism

Despite the challenges posed by the post-pandemic landscape, Urban Tots has remained steadfast in its commitment to ethical and sustainable practices. From sourcing organic materials to advocating for fair labor practices, the company has positioned itself as a champion of conscious consumerism – a trend that has gained significant traction among millennial and Gen Z parents.

This alignment with socially responsible values has endeared Urban Tots to a loyal customer base, potentially mitigating the impact of short-term fluctuations in demand. However, the company’s unwavering stance on sustainability has also raised concerns among some investors regarding the potential impact on profit margins and scalability.

Expansion Plans and International Ambitions

In a bid to capitalize on its brand equity and diversify its revenue streams, Urban Tots has embarked on an ambitious expansion plan. The company has opened a string of flagship stores in major metropolitan areas, catering to affluent urban parents seeking a curated shopping experience. Additionally, Urban Tots has set its sights on international markets, forging strategic partnerships and exploring opportunities for global growth.

While these initiatives have been met with enthusiasm by some analysts, others have expressed concerns about the potential dilution of the brand’s premium positioning and the inherent risks associated with global expansion. The success of these endeavors will undoubtedly shape the company’s future trajectory and, consequently, its share price performance.

Navigating the Competitive Landscape

Despite its strong brand identity and loyal following, Urban Tots is not immune to the competitive pressures of the children’s apparel industry. Established players and emerging disruptors alike are vying for market share, each leveraging unique strategies and value propositions to capture the attention of discerning parents.

Urban Tots’ ability to maintain its competitive edge will hinge on its capacity to innovate, both in terms of product offerings and customer experience. The company’s commitment to sustainability and ethical practices may offer a distinct advantage, but it will need to strike a delicate balance between upholding its values and remaining agile in the face of evolving market dynamics.

The Tapestry Unraveled: A Glimpse into the Future

As the tapestry of Urban Tots’ share price continues to unfurl, investors and analysts alike will be closely monitoring the company’s ability to navigate the challenges and capitalize on the opportunities that lie ahead. While the road ahead is uncertain, one thing is clear: Urban Tots’ unwavering commitment to its core values and its ability to anticipate and adapt to shifting consumer preferences will be pivotal in shaping its destiny.

Whether the company’s share price embarks on an upward trajectory or endures further turbulence remains to be seen. However, one thing is certain – the tapestry of Urban Tots’ fortunes is woven from threads of resilience, innovation, and a steadfast dedication to creating a more sustainable and ethical future for the next generation of little ones.