Unlocking Homeownership: A Complete Guide To VA Loan Eligibility

Being a homeowner is a big deal in this economy considering the increasing inflation and higher brokerage rates. As a veteran, active-duty service members, and their families buying a house may seem impossible, but fortunately, it is not. Rather, it is much easier if you fall into any of these categories. The VA loan program, funded by the U.S. Department of Veterans Affairs (VA), offers a solution to make homeownership more obtainable. It is a particular kind of mortgage specially designed to help those who have helped in the U.S. military and some of their lineage members to buy residences of their own in better conditions and with lower interest. Today, we will learn some essential points about the VA loan eligibility criteria.

What is a VA Loan?

It is a loan that the U.S. state initiates to help veterans, involved-duty service members, and certain family members. Unlike other types of mortgages, this offers many advantages not available anywhere else.

- No Down Payment: In most cases, you have to put some money down when buying a house, which can be an issue if you don’t have any big savings. The VA loan does not require such payments.

- No Private Mortgage Insurance: Most loans require you to pay at least twenty % interest of the home price upfront, otherwise you have to pay extra for insurance. With a VA loan you can get past these formalities and expenses and save some extra money.

- Lower Interest Rates: These are known to have lower interest rates than conventional loans. This way you can pay a lower amount every month.

- Lower Closing Costs: It puts a limit on the amount a lender can charge you when closing, making the process of buying a home more affordable.

Who is Eligible for a VA Loan?

Everyone is not eligible for this VA loan, you must meet some requirements to get the benefits based on your military service or relationship with someone who served.

-

Veterans

People who served in the U.S. Army, Navy, Air Force, Marines, or Coast Guard pass the VA loan eligibility. This includes:

- Length of Service: They are supposed to have served for at least 90 days of functional duty during war or 181 days during peacetime. However, these measures can vary based on how long and for what time they served.

- Proper Discharge: People who were not discharged due to issues like bad performance or ill behavior or are separated for reasons that could disqualify them get this honorable discharge.

-

Active-Duty Service Members

If you are currently working in the army, then you might be eligible for this loan. You have to serve continuously for at least 90 days of active service to qualify.

-

National Guard and Reserves

These people might also be qualified to get the VA loan from the officials without much worry. You usually need to have completed six years of service. You may also qualify if you were called to active duty for at least 90 days during a federal mission.

-

Surviving Spouses

If your partner or someone who was a veteran that died on duty or was disabled during the drill, then you will be eligible; however, in some cases, if you are remarried, you might not get the benefits.

-

Other Special Cases

Specific other groups, such as people who served in typical medical or other governmental roles, may also qualify. If you are unsure, then you can check with the VA or a lender who specializes in VA loans.

Key Advantages of a VA Loan

There are many reasons why VA loans are much better than others. Here are some factors you should consider:

- No Down Payment: The biggest advantage of this loan is that you do not have to give any money in advance. It is great for people who don’t have any money saved up.

- Lower Interest Rates: They give loans at affordable interest rates, which is not so common with other traditional options.

- No PMI: With other alternatives like the conventional loan, you need to disburse the PMI of 20 percent, but with VA you can cut yourself some margin.

- Easier to Privilege: VA loans tend to have more flexible credit and income conditions, making it more effortless for veterans to qualify, even if their score isn’t perfect.

- Capped Closing Fees: VA loans tend to have more relaxed credit and revenue requirements, making it easier for veterans to get, even if their score isn’t perfect. It limits the amount of closing money the lender can charge, making it a much more affordable option overall.

Common Myths About VA Loans

There are many misunderstandings in people about VA loans that should be resolved as soon as possible. Let’s debunk some common misconceptions:

- VA Loans Are Only for First-Time Homebuyers: This is the most popular myth, but fortunately it is not true. Veterans can use this loan as many times as possible as long as they meet the eligibility requirements.

- VA Loans Are Hard to Qualify For: While most people still believe that, but again it is false, in fact, they are one of the easiest loans to qualify for, as you don’t need any strict qualifications.

- VA Loans Take Forever to Close: It is true that VA loans might take a bit longer than traditional loans, as they require a lot of paperwork, but it’s not typically a long or complicated process.

Conclusion

VA loan eligibility is not that hard to understand and can be beneficial to veterans, active veterans, and their families. The factor mentioned above explains the qualification needs and advantages of VA loans over other loans. With the right preparation and guidance, you can make homeownership a reality.

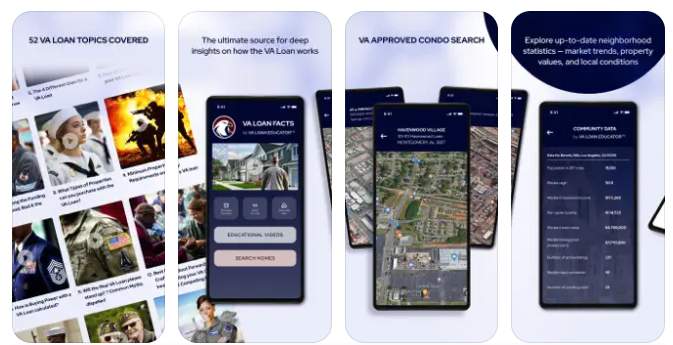

The VALoanEducator app offers intense information on various topics and confusion about the VA loan. It is popular for its simple, intuitive design and helpful resources to guide you through the process and ensure you get the best deal possible.