Top Ten Best Car Loan Calculators in Malaysia 2025

When it comes to purchasing a car, understanding your financing options is crucial. A car loan calculator can help simplify this process by allowing you to estimate your monthly payments, interest rates, and the total cost over the loan’s duration. In Malaysia, several online tools make it easy for prospective car owners to assess their financial obligations. Below, we will explore the top ten loan calculators available in Malaysia, highlighting their features, usability, and how they can aid you in making informed decisions.

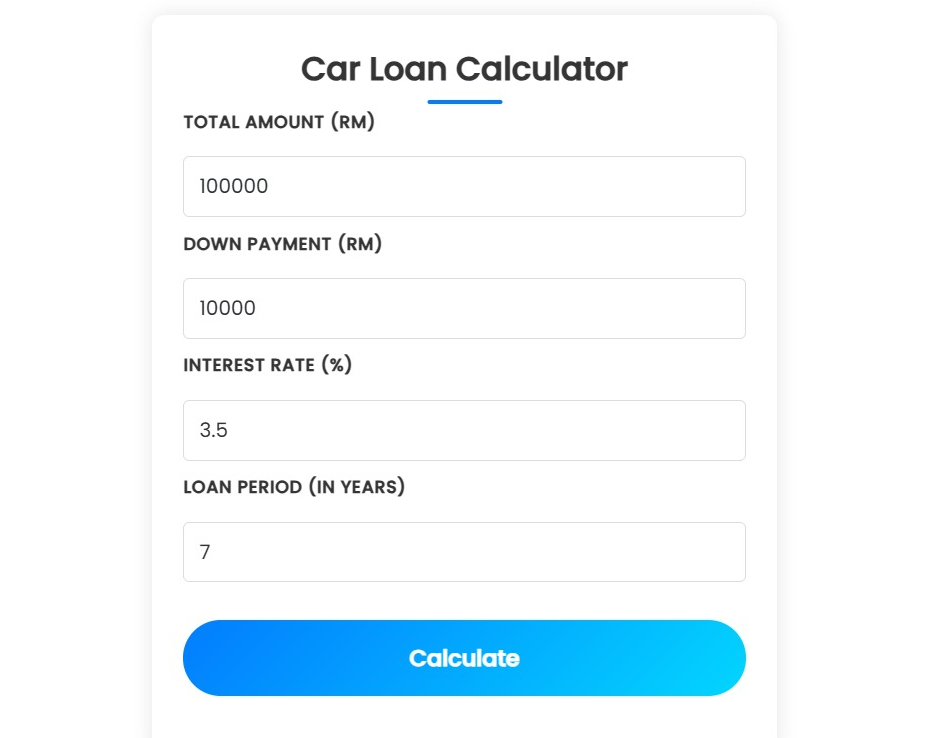

1. Carlist Malaysia Car Loan Calculator

Carlist Malaysia’s Car Loan Calculator is one of the most popular options among Malaysians. It’s user-friendly and allows you to estimate your monthly payments based on the car price, down payment, interest rate, and loan tenure. You can easily modify these variables to see how they affect your payment. Their website provides a lot of additional resources, including car reviews and financing tips, making it a one-stop shop for car buyers.

Key Features:

- Adjustable inputs for car price, down payment, interest rate, and loan tenure.

- Clear breakdown of loan details and payment structure.

- Additional resources related to car buying and ownership.

2. Maybank Car Loan Calculator

Maybank’s online calculator is another excellent resource. It offers a straightforward interface that allows you to input your loan amount and term, giving you an immediate estimate of your monthly payment. Maybank also provides comprehensive information about its financing products, including various loan packages tailored to diverse consumer needs.

Key Features:

- Direct access to Maybank’s financing options.

- Quick calculations with instant results.

- Variable loan term options from 1 to 9 years.

3. CIMB Bank Car Loan Calculator

CIMB Bank offers an intuitive car loan calculator that gives potential borrowers an easy way to understand their financing options. With CIMB, users can input different interest rates, calculate respective monthly payments, and get a total even before visiting the bank. Additionally, the bank provides different loan plans tailored to various purchasing needs, making it easy to find the right option for you.

Key Features:

- Adjustable interest rates for precise calculations.

- User-friendly interface and quick results.

- Information about CIMB’s specific loan packages.

4. Hong Leong Bank Car Loan Calculator

Hong Leong Bank’s car loan calculator is known for its simplicity and efficiency. It allows users to calculate estimated monthly payments based on the loan amount, interest rate, and period. The calculator also offers informative links toward loan details and other essential banking services.

Key Features:

- Clear and concise layout for easy navigation.

- The ability to modify variables such as down payment and tenure.

- Provides users with a snapshot of loan-related terms and services.

5. Public Bank Car Loan Calculator

Public Bank’s car loan tools is another strong choice in Malaysia’s automotive financing space. Users can input detailed information about the loan, including the total cost of the vehicle and the percentage of down payment. The tool provides results in just a few clicks, with added insights into different financing products available at Public Bank.

Key Features:

- Customizable input fields for personalized results.

- Instant access to a variety of loan options.

- Information on Public Bank’s competitive interest rates.

6. RHB Bank Car Loan Calculator

RHB Bank provides a well-structured car loan calculator where users can calculate their monthly payments with great ease. The tool is designed to help users estimate the total cost of the loan, including monthly payments, and gives a quick overview of what to expect in terms of affordable repayments.

Key Features:

- Simplified calculation process with instant results.

- Provides insight into various loan products from RHB.

- Option to explore loan repayment frequencies.

7. Affin Bank Car Loan Calculator

Affin Bank’s calculator is a thoughtful tool for individuals looking for quick estimations of their car loan repayments. Users can input the principal amount, interest rate, and tenure to get a comprehensive understanding of their monthly obligations.

Key Features:

- Clean interface that is easy to use.

- Quick calculations with immediate feedback.

- A helpful guide toward different financing options offered by Affin Bank.

8. Axis Bank Car Loan Calculator

Axis Bank’s calculator offers detailed estimations of monthly payments along with total payment breakdowns. Users can easily switch between different car prices, down payments, and tenures to find out what fits best into their monthly budget.

Key Features:

- Detailed breakdown of monthly payment schedules.

- Customizable input fields for dynamic results.

- Provides comparative information on Axis Bank’s car loans.

9. BSN Car Loan Calculator

Bank Simpanan Nasional (BSN) offers an efficient car loan calculator that allows users to process various financing options quickly. The tool is very accessible and caters to a broad audience looking for competitive rates and payment estimates.

Key Features:

- Comprehensive calculation possibilities.

- Simple and user-friendly design.

- Access to BSN’s range of car loan products.

10. Standard Chartered Car Loan Calculator

Standard Chartered’s car loan calculator is well-designed, offering users the ability to adjust different factors like loan amount and interest rates to gauge their payments accurately. The tool also links to additional information related to financing options and advisory services.

Key Features:

- Useful visualizations of loan terms.

- Direct link to inquire about loan products.

- A guide is provided on how to maximize loan benefits.

Conclusion

Choosing the right loan calculator is vital for navigating the financial aspects of purchasing a vehicle in Malaysia. Each of the calculators listed above provides unique features and capabilities, ensuring that prospective car buyers have the necessary tools to make sound financial decisions.

When utilizing these calculators, it’s essential to input accurate information to get the most reliable estimates. Factors such as the car’s price, down payment, loan tenure, and interest rates can vary widely, affecting the final outcome of your calculations.

For comprehensive financing resources in Malaysia, the Carlist Malaysia Car Calculator is an excellent starting point. It provides not just a calculator but also valuable insights into the car market, helping you to make informed decisions based on your financial situation.

Ultimately, conducting thorough research, weighing all financing options, and utilizing the best tools available will empower you in your car-buying journey, ensuring that you find not only the right vehicle but also the right financing plan to suit your lifestyle and budget.