The most popular option is the latest personal line of credit

What is actually an opposing home mortgage?

An opposite mortgage was financing which enables property owners 62 and you will more mature to alter a portion of their residence equity to the cash and you will postponed installment until it die, offer the home, otherwise escape of the property.

Now, really, although not all the, reverse mortgage loans try Domestic Equity Transformation Mortgage (HECM) loans-truly the only reverse mortgage loans insured because of the Federal Casing Government (FHA).

How does a contrary mortgage performs?

With a reverse mortgage, you borrow secured on this new equity of your property. Household guarantee is simply the newest worth of your home minus any mortgage equilibrium(s)-or no-you owe on your own household. In the place of a traditional mortgage for which you afford the financial for every single few days, with an opposing financial the lending company will pay your (think of it because a progress in your domestic equity).

Opposite mortgage loan continues

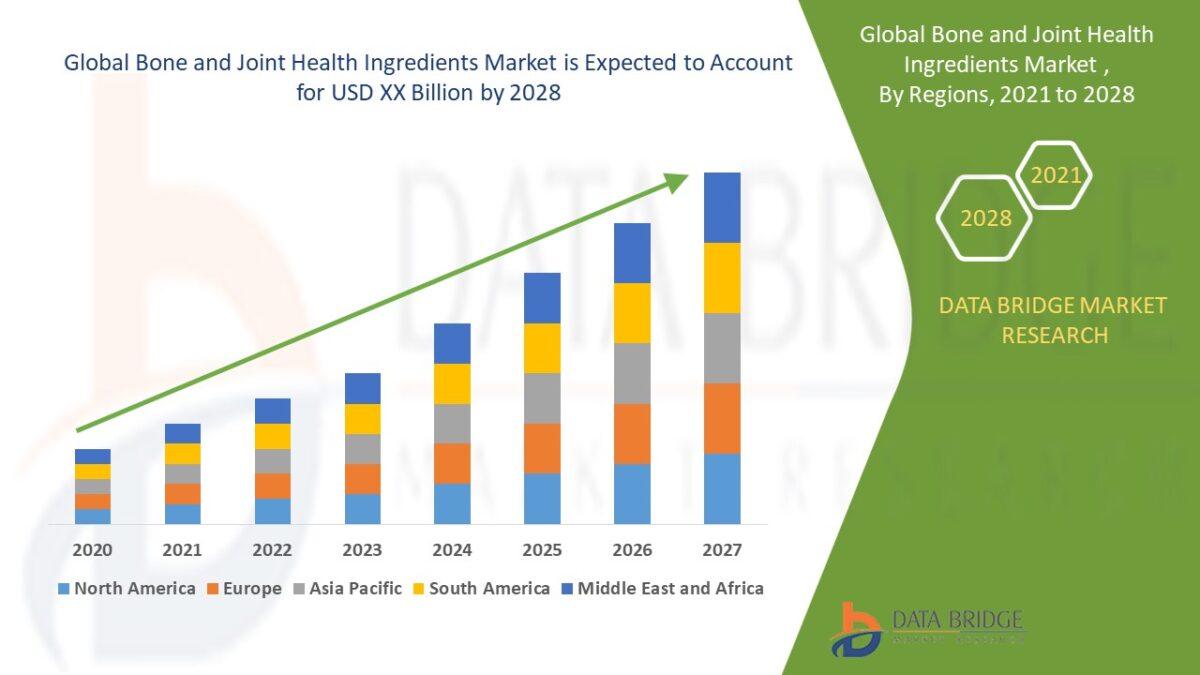

The degree of funds you can even meet the requirements to get utilizes how old you are, new appraised property value your home, plus the most recent interest rates.

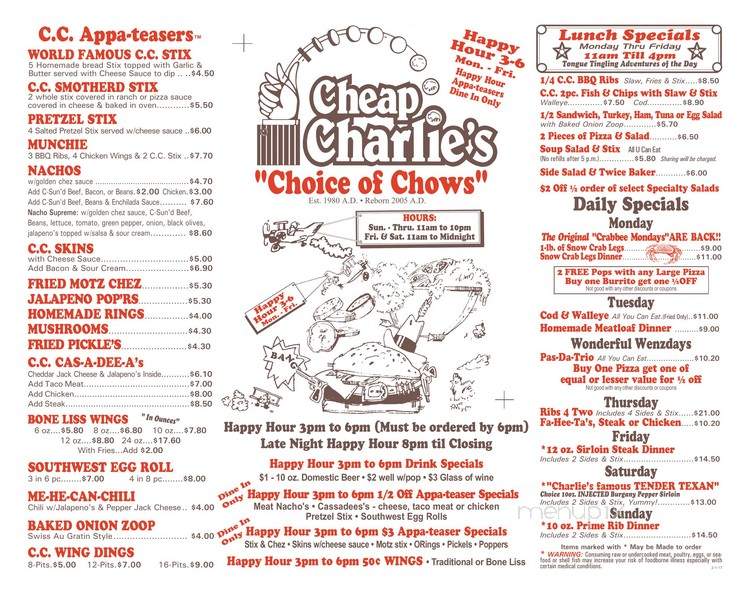

There are a variety out of methods for you to love to located their proceeds, and additionally just one, lump-share disbursement; a credit line; otherwise a month-to-month cashflow payment (having a set age weeks or higher the life out of the loan).

You only pay desire to your money you use, in addition to bare portion of the offered borrowing develops through the years (in one price just like the loan harmony)-providing you access to so much more readily available money through the years.

You need the opposite mortgage loan continues however wantmon spends should be supplement old-age income; repay (refinance) a recently available home loan; consolidate loans; buy when you look at the-homecare otherwise home reily.

Like most different kind away from lent money, contrary home loan continues are often not subject to income tax.* The Personal Cover and you may first Medicare aren’t impacted.

The loan balance and you may cost

Which have an opposite financial, the newest unpaid mortgage harmony grows over time. While the a borrower, you might spend as often or only a small amount towards the borrowed funds harmony monthly as you wish, or you can build no month-to-month mortgage payments at all. Needless to say, you’ve kept to keep up your house and you may pay assets taxation and homeowners insurance.

So long as you satisfy all of the terms of the mortgage, the borrowed funds equilibrium just becomes due official website if the house is no expanded the majority of your house (elizabeth.g., you permanently escape or die).

The loan is normally met through the revenue of the property. In case your heirs are interested the house, they may be able if you are paying 95% of your appraised worthy of or paying off the borrowed funds harmony, whatever are faster. They’re able to along with love to refinance the house into their title or maybe just leave (in which particular case the home is frequently in love with the unlock market).

You, or their heirs, keep the leftover proceeds (if any) adopting the financing try repaid. In case the financing harmony due on the contrary home loan is higher than new house value, neither your, your own house neither your own heirs have the effect of repaying this new deficit-due to the loan’s low-recourse feature.**

Reverse mortgage loan will cost you

Just like the reverse mortgage will cost you may be higher priced than simply a traditional mortgage, it can also give you greater monetary liberty in old age, as you possibly can enhance your cash flow and you will installment can be deferred in order to a later date.

All the upfront can cost you-assessment percentage, third-class settlement costs, very first home loan advanced (MIP, which is calculated on dos.0% of one’s loan’s maximum claim matter), and you can financing origination commission (have a managed cover according to the house’s appraised well worth)-is rolling into contrary real estate loan. That exception to this rule ‘s the HECM counseling commission, that is up to $125 and may be paid initial and you will out-of-pocket.