Mexico Flat Glass Market Share, Size, Growth & Insights by 2034

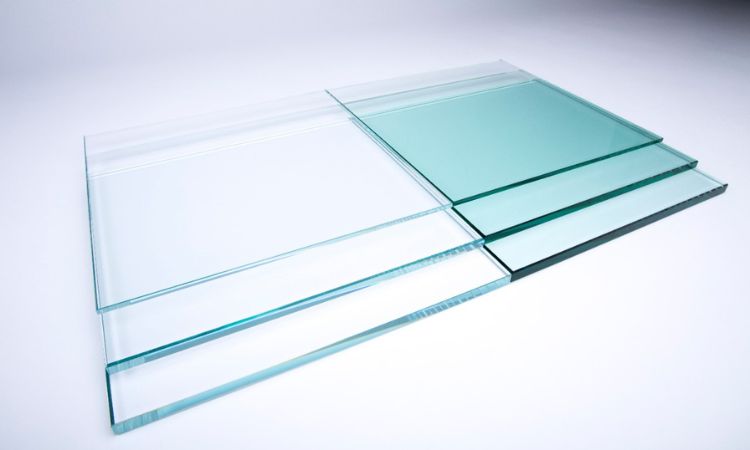

The Mexico Flat Glass Market Size has shown substantial growth over the past few years, driven by increasing demand across various industries, including construction, automotive, and electronics. Flat glass refers to any glass that is manufactured in flat sheets, used in windows, mirrors, and other applications. As of 2024, the market value is estimated to be around USD 1,090.11 million, and it is expected to continue growing with a CAGR of 4.2% from 2025 to 2034, reaching nearly USD 1,460.35 million by 2034. This growth can be attributed to key driving factors such as expanding urbanization, technological advancements in manufacturing, and the rise in infrastructure development projects.

Key Benefits of the Mexico Flat Glass Market

The flat glass market in Mexico offers several benefits that contribute to its growth:

- Versatility in Applications: Flat glass finds wide usage across various sectors, particularly in construction (for windows, facades, and interiors), automotive (windshields, sunroofs), and electronics (displays, touchscreens). This broad range of applications helps the market maintain strong demand in multiple industries.

- Technological Advancements: Innovations in glass manufacturing, including the development of energy-efficient glass and smart glass, have opened up new possibilities in energy conservation and automation, making it an attractive option for modern architecture and automotive design.

- Sustainability: With growing environmental concerns, the market is shifting towards green glass products, which reduce energy consumption and environmental impact. Energy-efficient glazing, which helps in controlling solar heat gain, plays a key role in promoting sustainable construction practices.

- Enhanced Aesthetic Appeal: Flat glass contributes significantly to the aesthetic value of modern buildings and vehicles, providing sleek, clean, and sophisticated looks that enhance the overall design.

Key Industry Developments

Over the last few years, the Mexico flat glass market has witnessed several significant developments that have played a role in shaping the market’s dynamics:

- Technological Innovations: Companies are focusing on developing advanced glass types, such as low-emissivity (Low-E) glass, tinted glass, and electrochromic glass. These innovations help reduce energy consumption by controlling the amount of heat and light entering buildings and vehicles.

- Shift Towards Green Building Materials: As part of Mexico’s push for sustainability, there has been an increased focus on using energy-efficient and eco-friendly glass for buildings. This trend is in line with global sustainability goals, especially the need to reduce carbon footprints.

- Growing Demand from the Automotive Industry: Mexico has long been a manufacturing hub for the automotive sector, and flat glass plays a critical role in vehicle production. The demand for lightweight and energy-efficient glass has grown, driven by technological advancements in vehicle design and energy efficiency.

- Expansion of Manufacturing Capacities: Major global players in the glass manufacturing industry have been investing in expanding production capacities and distribution networks in Mexico to meet growing demand from both domestic and international markets.

Driving Factors

The Mexico flat glass market is driven by several factors, each contributing to its growth:

- Urbanization and Infrastructure Development: As urbanization continues to grow in Mexico, there is a greater need for residential, commercial, and industrial buildings. This is driving demand for high-quality flat glass for construction and architectural applications.

- Government Initiatives: The Mexican government has supported the construction industry through various initiatives and incentives aimed at boosting housing and infrastructure projects. These policies, combined with favorable tax structures for green building materials, are expected to continue driving demand for flat glass.

- Rise in Automotive Production: Mexico is one of the largest automotive manufacturing countries in the world. This has spurred a substantial demand for automotive flat glass, particularly for windshields, windows, and other automotive applications.

- Technological Advancements in Glass Manufacturing: The use of advanced technologies in glass manufacturing, such as automated production lines and innovations in energy-efficient glass, has significantly enhanced production efficiency and product quality, meeting the growing demand in both the construction and automotive industries.

COVID-19 Impact

Like many other industries, the Mexico flat glass market was impacted by the COVID-19 pandemic. The global supply chain disruptions, coupled with reduced demand during the lockdown periods, led to production delays and inventory shortages. The construction and automotive sectors, which are key consumers of flat glass, were particularly affected due to halts in projects and production activities.

However, post-pandemic recovery has been observed, with the market gradually returning to growth. The demand for building materials in the residential and commercial sectors has surged, and automotive production in Mexico has rebounded strongly. While the pandemic caused temporary setbacks, the market is expected to grow steadily in the coming years, thanks to the ongoing demand from key sectors.

Restraining Factors

While the Mexico flat glass market has significant growth potential, there are several challenges that could hinder its growth:

- Fluctuating Raw Material Prices: The price of raw materials such as silica sand, soda ash, and limestone can be volatile, which affects production costs and profitability. These price fluctuations may deter smaller manufacturers from expanding their operations.

- Environmental Concerns: Although flat glass has energy-efficient applications, the manufacturing process itself can be environmentally harmful. The production of glass requires significant energy consumption, which contributes to carbon emissions. Manufacturers are now focused on finding sustainable alternatives, but the transition can be costly.

- Competition from Substitutes: Other materials such as acrylic sheets, polycarbonate, and tempered plastic are increasingly being used as substitutes for flat glass in specific applications, especially in cost-sensitive markets. This increases competition in the market.

Market Segmentation

The Mexico flat glass market can be segmented based on the following factors:

Type

- Float Glass: The most common type of flat glass, used in the construction and automotive industries due to its clarity and versatility.

- Tempered Glass: Known for its strength and safety features, tempered glass is used in applications where high resistance to heat and impact is required, such as automotive and architectural glazing.

- Laminated Glass: This type of glass is made by bonding layers of glass with a polymer interlayer, enhancing safety and sound insulation properties.

- Low-E Glass: Used primarily for energy-efficient buildings, this glass helps reduce heat loss and gain, making it popular in green construction projects.

Application

- Construction: This includes residential, commercial, and industrial applications. The construction segment is the largest consumer of flat glass, driven by demand for energy-efficient windows, doors, and facades.

- Automotive: This segment has a strong presence in the market due to Mexico’s position as a major automotive manufacturing hub.

- Electronics: Flat glass is used in electronic devices like smartphones, televisions, and computers, contributing to the market growth.

End-Use Industry

- Residential: The residential sector continues to be a major driver for the market, particularly for windows and facades in new homes and renovation projects.

- Commercial: Commercial buildings such as offices, retail stores, and shopping malls also contribute significantly to the market.

- Automotive: With Mexico being one of the largest automotive manufacturers globally, the automotive sector remains a major consumer of flat glass products.

Market Outlook

The Mexico flat glass market is expected to experience robust growth over the forecast period of 2025-2034. Factors such as urbanization, increasing demand for energy-efficient products, and expanding manufacturing capabilities are expected to propel the market forward. The construction and automotive sectors will remain key drivers of demand, while new trends such as the use of smart glass and energy-efficient glazing will continue to shape the future of the market.

Key Players in the Market

Several major players operate in the Mexico flat glass market, including:

- Vitro, S.A.B de C.V

- Saint Gobain S.A.

- Guardian Glass LLC

- AGC Inc.

- Nippon Sheet Glass Company Ltd.

- Others

Opportunities

- Growth in Green Building Projects: As sustainability becomes a key focus in the construction sector, the demand for energy-efficient and eco-friendly flat glass will increase, offering significant growth opportunities.

- Automotive Expansion: With increasing automotive production, particularly in Mexico’s growing electric vehicle market, demand for specialized flat glass products like lightweight glass and windshield technologies is expected to rise.

Challenges

- High Raw Material Costs: Rising raw material costs pose a challenge to the profitability of flat glass manufacturers.

- Environmental Regulations: Stricter environmental regulations around emissions and production processes may require substantial investment in cleaner technologies.