Credit Score – Check FREE CIBIL Score Online | No Impact

Your credit score, often referred to as the CIBIL score, is a crucial indicator of your financial health and creditworthiness. Understanding how to check your credit score online is essential for monitoring your financial standing and making informed decisions regarding loans and credit cards. In this guide, we’ll go over the basics of credit scores, their significance, and how you can check your credit score online for free.

What is a Credit Score?

A credit score takes your credit history into a concise 3-digit number, offering a snapshot of your creditworthiness. It’s calculated based on factors such as payment history, credit utilisation, length of credit history, types of credit accounts, and recent credit inquiries. This score, often referred to as the CIBIL score, provides lenders with insight into your financial behaviour, helping them assess the risk associated with extending credit to you. Essentially, it reflects how responsibly you’ve managed credit in the past and predicts your likelihood of repaying future debts.

Why Does Your Credit Score Matter?

Your credit score is a critical factor in the lending process as it influences the terms and conditions of credit you can access. Lenders rely on your credit score to gauge the level of risk they undertake by lending to you. A higher credit score signifies a lower risk of default, making you more attractive to lenders and enabling you to secure loans at favourable interest rates and terms. Conversely, a lower credit score may limit your borrowing options and result in higher interest rates or outright loan denials. Therefore, maintaining a good credit score is vital for ensuring financial flexibility and favourable borrowing opportunities.

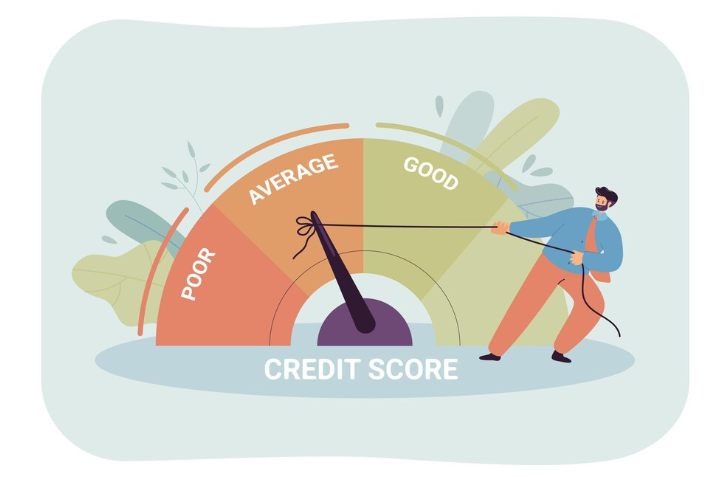

Understanding Credit Score Ranges

Credit scores fall within a spectrum that ranges from 300 to 900, with each range conveying a different level of credit risk. A score below 300 indicates either no credit history or insufficient data for scoring purposes. Scores between 300 and 550 are considered very low and suggest significant credit risk. A range of 551 to 620 signifies a low credit score, indicating a higher likelihood of default. Scores from 621 to 700 are categorised as fair, suggesting an average level of creditworthiness. A score of 701 to 749 is considered good, reflecting responsible credit management. Finally, a score of 750 and above is excellent, indicating a very low credit risk and strong creditworthiness. Understanding these ranges helps individuals gauge where they stand in terms of credit health and take steps to improve it if necessary.

Checking Your Credit Score Online: Methods and Options

- Credit Bureaus: Credit bureaus are entities regulated by the Reserve Bank of India (RBI) tasked with compiling individuals’ credit information. They collect data from various financial institutions and create credit reports and scores reflecting individuals’ creditworthiness. As per RBI regulations, individuals are entitled to receive one free credit report and score annually from credit bureaus. This report provides a comprehensive overview of one’s credit history, helping individuals monitor their financial health. To obtain your free credit report, visit the official website of a recognised credit bureau. Alternatively, you can request a free credit report by mail from the respective credit bureau. This allows individuals to stay informed about their credit standing without incurring additional costs.

- Third-Party Financial Portals: Numerous third-party financial portals exist, offering services beyond those provided directly by credit bureaus. These portals often provide additional features such as financial management tools, personalised recommendations, and educational resources. Many of these third-party portals offer free credit score checks as part of their services. Unlike some credit inquiries that can negatively impact your credit score, checking your score through these platforms typically doesn’t affect it. Accessing your credit score through these portals is typically simple. Users can visit the portal’s website or use its mobile app, follow the instructions provided, and receive their credit score promptly and conveniently.

Final Word

Checking your credit score online is a simple yet crucial step in managing your financial health. By understanding your credit score and monitoring it regularly, you can take proactive steps to improve your creditworthiness and secure better loan terms in the future. Whether through credit bureaus or third-party financial portals, accessing your credit score has never been easier, empowering you to make informed financial decisions with confidence.