Understanding LLC Formation in Texas: A Comprehensive Guide

Forming a business entity is a significant decision for entrepreneurs, and one of the most popular options is the Limited Liability Company (LLC). This comprehensive guide will delve into the specifics of forming an LLC in Texas.

Why Choose an LLC in Texas?

Texas is known for its business-friendly environment, making it an attractive choice for entrepreneurs. An LLC offers limited liability protection to its owners while providing flexibility in management and taxation.

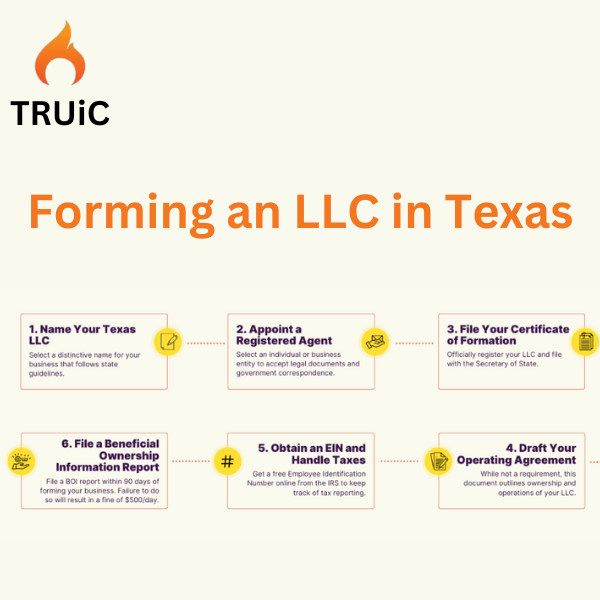

Steps to Form an LLC in Texas

Choose a Unique Name

Your LLC name must be distinguishable from existing businesses in Texas. It should include “Limited Liability Company” or an abbreviation like “LLC.” Conduct a name availability search and reserve your desired name if necessary.

File Certificate of Formation

Prepare and file the Certificate of Formation with the Texas Secretary of State. Include details such as the LLC‘s name, registered agent, management structure, and purpose.

Appoint a Registered Agent

Every Texas LLC must have a registered agent with a physical address in the state. The agent is responsible for receiving legal documents on behalf of the LLC.

Create an Operating Agreement

Although not required by law, creating an Operating Agreement outlining the LLC’s management structure, member responsibilities, and decision-making processes is advisable.

Obtain Employer Identification Number (EIN)

Apply for an EIN from the Internal Revenue Service (IRS). This unique number is necessary for tax purposes, hiring employees, and opening bank accounts.

Comply with Tax and Regulatory Requirements

Fulfill Texas tax obligations, such as obtaining a Sales Tax Permit if your LLC engages in taxable sales. Additionally, comply with any industry-specific regulations and licensing requirements.

Click Here to Jump to the Next:

Benefits of an LLC in Texas

- Limited Liability Protection: Owners’ assets are protected from LLC debts and liabilities.

- Tax Flexibility: Texas LLCs have options for taxation, including pass-through taxation or electing to be taxed as a corporation.

- Flexible Management: LLC members can choose to manage the company themselves or appoint managers.

- Credibility: Operating as an LLC can enhance your business’s credibility and professionalism.

- Privacy: Texas offers privacy protection for LLC members, as personal information is not publicly disclosed in most cases.

Challenges and Considerations

While forming an LLC in Texas offers numerous benefits, there are some considerations to keep in mind:

- Annual Franchise Tax: Texas LLCs are subject to an annual franchise tax based on their gross receipts. Understanding and fulfilling tax obligations is crucial.

- Compliance Requirements: LLCs must comply with Texas regulatory requirements, including annual filings and maintaining good standing.

- Legal Formalities: Although less complex than corporations, LLCs still require adherence to legal formalities such as record-keeping and meeting minutes.

- Professional Assistance: Consulting with legal and tax professionals can ensure compliance and optimize your LLC structure for your business goals.

Conclusion

Forming an LLC in Texas offers entrepreneurs a blend of liability protection, tax flexibility, and management options. By following the steps outlined in this guide and considering the benefits and challenges, you can establish a strong legal foundation for your business in the Lone Star State.

Some FAQs

What is an LLC, and why should I consider it in Texas?

An LLC is like a shield that protects your stuff (like your car or savings) if your business has problems. In Texas, it’s a good choice because it’s simple to set up and gives you some legal protection.

How do I start an LLC in Texas?

To start an LLC in Texas, you need a unique name for your business, fill out some paperwork (called a Certificate of Formation), choose someone to receive legal papers (like a mail person), and make rules for how your business will work (like who makes decisions).

What are the good things about having an LLC in Texas?

Having an LLC in Texas means you’re not personally responsible if your business owes money or gets sued. It also makes taxes a bit easier because you can choose how you want to pay them.

What do I have to do to keep my LLC running in Texas?

To keep your LLC going in Texas, you need to pay a tax every year based on your business’s income. You also need to keep track of important business stuff, like money coming in and going out.

Can I change my business to an LLC in Texas if I already started it another way?

Yes, you can change your business to an LLC in Texas. It’s a bit of paperwork, but it’s doable. Just make sure you understand the rules and talk to someone who knows about business stuff to help you.