Merchant Accounts Unleashed: Boost Your Business Beyond Boundaries

In the ever-evolving landscape of business, having a solid financial infrastructure is crucial. One key element that can significantly impact the growth and reach of your business is a merchant account. In this article, we’ll delve into the world of merchant accounts, exploring their types, functionalities, benefits, challenges, and the latest trends shaping the industry.

Definition of Merchant Accounts

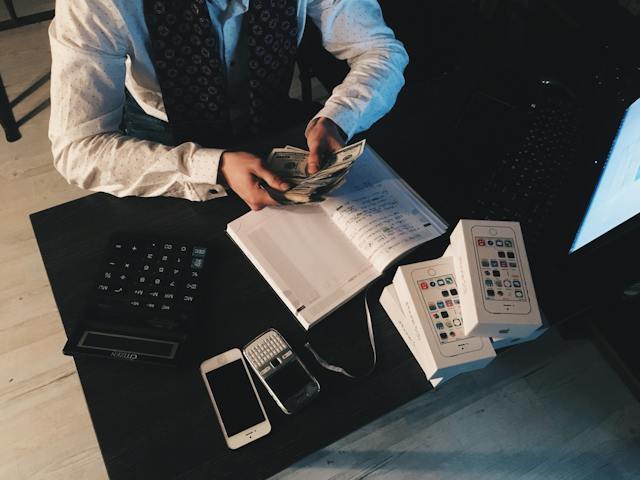

A merchant account is a specialized bank account that allows businesses to accept payments, typically through credit or debit cards. It acts as an intermediary between the business, the customer, and the payment processor.

Importance of Merchant Accounts for Businesses

In a digital age where cash transactions are decreasing, having a high risk merchant account at highriskpay.com opens up a world of opportunities for businesses. It not only facilitates smooth transactions but also enhances the credibility of the business in the eyes of the consumers.

Types of Merchant Accounts

Retail Merchant Accounts

Primarily used by brick-and-mortar stores, retail merchant accounts are designed for face-to-face transactions. They often involve the use of point-of-sale (POS) terminals for card swiping.

Internet Merchant Accounts

Tailored for online businesses, internet merchant accounts enable seamless online transactions. They come with secure payment gateways to ensure the safety of online payments.

Mail and Telephone Order Merchant Accounts

For businesses that accept payments through mail or over the phone, these accounts provide a secure way to process transactions without the physical presence of the card.

How Merchant Accounts Work

Transaction Process

When a customer makes a purchase, the merchant account facilitates the transfer of funds from the customer’s card to the business’s account. This involves authorization, capturing, and settlement stages.

Role of Payment Processors

Payment processors play a crucial role in connecting the merchant account with the customer’s bank. They ensure the secure and swift transfer of funds.

Security Measures in Merchant Transactions

To instill trust, merchant accounts implement robust security measures, including encryption and two-factor authentication, protecting both the business and the customer.

Benefits of Having a Merchant Account

Increased Sales Opportunities

Accepting card payments broadens the customer base, as many consumers prefer the convenience of cards over cash.

Credibility and Trust

Businesses with merchant accounts are often perceived as more trustworthy, as they demonstrate a commitment to providing convenient payment options.

Streamlined Payment Processes

Merchant accounts simplify the payment process, reducing the hassles associated with cash handling and check processing.

How to Choose the Right Merchant Account

Consideration of Business Type

Different businesses have different needs. Choosing a merchant account tailored to your business type is crucial for optimal functionality.

Fee Structure

Understanding the fee structure is essential to avoid unexpected charges. Factors like transaction fees, monthly fees, and chargeback fees should be considered.

Security Features

In an era of increasing cyber threats, prioritizing security features in a merchant account is non-negotiable. Look for accounts with robust security protocols.

Common Challenges with Merchant Accounts

Chargebacks

Chargebacks can be a headache for businesses. Understanding the causes and implementing preventive measures is key to managing them effectively.

Fraud Prevention

As technology advances, so do fraudulent activities. Merchant accounts need to stay ahead with sophisticated fraud prevention measures.

Understanding Terms and Conditions

Misinterpreting or neglecting the terms and conditions of a merchant account can lead to complications. Businesses must invest time in understanding the fine print.

Merchant Account Best Practices

Regular Monitoring and Analysis

Stay proactive by regularly monitoring transactions and analyzing patterns. This helps in early detection of anomalies.

Updating Security Protocols

As technology evolves, so do security threats. Regularly update and upgrade security protocols to stay ahead of potential risks on merchant cash advance blursoft.

Customer Support and Communication

Offering reliable customer support and clear communication channels can resolve issues swiftly, fostering customer trust.

Emerging Trends in Merchant Accounts

Cryptocurrency Integration

The rise of cryptocurrencies opens new avenues for transactions. Merchant accounts integrating cryptocurrency payments cater to a tech-savvy customer base.

Contactless Payments

Contactless payments are becoming increasingly popular for their convenience. Merchant accounts supporting contactless technology stay ahead in meeting consumer expectations.

Artificial Intelligence in Transaction Processing

Artificial Intelligence streamlines transaction processing, reducing the risk of errors and improving efficiency in merchant accounts.

Success Stories: Businesses Thriving with Merchant Accounts

Small Business Case Studies

Explore how small businesses have expanded their reach and revenue with the implementation of merchant accounts.

E-commerce Success Stories

E-commerce giants stand as testaments to the transformative power of merchant accounts. Learn from their strategies and successes.

Future Outlook of Merchant Accounts

Evolving Technologies

Stay informed about the latest technologies shaping the future of merchant accounts, from blockchain to biometrics.

Changing Consumer Behavior

Understanding how consumer preferences evolve helps businesses adapt their merchant account strategies accordingly.

Regulatory Developments

Keep an eye on regulatory changes that may impact merchant account operations. Compliance is key to a successful and sustainable business.

Conclusion

Merchant accounts are indispensable for businesses looking to thrive in the modern marketplace. From increased sales opportunities to streamlined payment processes, the benefits are vast. If your business hasn’t embraced the power of merchant accounts, now is the time. Explore the options, choose wisely, and watch your business soar beyond boundaries.

FAQs

- What is a merchant account, and why do businesses need one?

A merchant account is a specialized bank account that allows businesses to accept card payments, enhancing credibility and expanding sales opportunities.

- How do I choose the right merchant account for my business?

Consider your business type, understand the fee structure, and prioritize security features when choosing a merchant account.

- What are the common challenges businesses face with merchant accounts?

Common challenges include chargebacks, fraud prevention, and the importance of understanding terms and conditions.

- How can businesses stay ahead with their merchant accounts?

Regular monitoring, updating security protocols, and offering excellent customer support are key practices for success.

- What are the emerging trends in merchant accounts?

Trends include cryptocurrency integration, contactless payments, and the use of artificial intelligence in transaction processing.