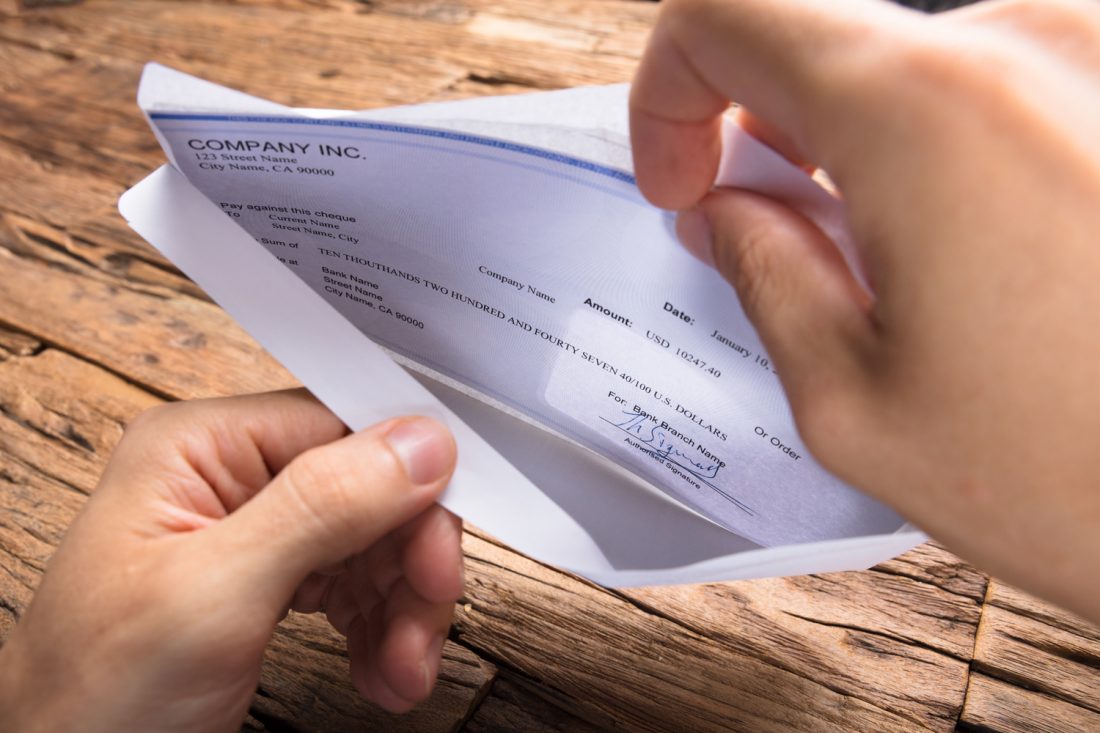

How to understand your first paycheck

You just got your first check and – surprise! – it might be a little smaller than you expected.

Don’t worry, there is no problem. Your employer has simply deducted an amount for payroll-related expenses (and possibly some optional ones). This is why you see so many deductions.

Here are some terms related to your paycheck or paycheck that you’re going to want to understand better, as well as a breakdown of what is typically deducted and why.

GROSS INCOME ( GROSS PAY )

This is the amount of your salary before deductions are made, mentions the Consumer Financial Protection Bureau (CFPB). For example, if you make $ 45,000 a year and are paid monthly, your gross salary should be $ 3,750 ($ 45,000 divided by 12 months). If you are paid twice a month or every two weeks, the gross amount will be approximately $ 1,875 for each check (see “Pay Period”)

NET PAY ( NET PAY )

N eto means the amount of money left after taxes and other deductions from circumventing. This is the actual amount that you can collect or that is automatically deposited into your bank account, says the CFPB.

PAYMENT PERIOD ( PAY PERIOD )

This means how often you get paid. The CFPB mentions that this is programmed by your employer. The most common pay periods are monthly, biweekly, semi-annually, or weekly.

MARITAL STATUS ( FILLING STATUS )

When you fill out the necessary documents to start working, you will have to fill out a W-4 * form. At that time, you may mention if you are married, single, if you are completing the form jointly if you are married, if you are a head of the family or a qualified widower with a dependent child, according to the Internal Revenue Service (IRS, for its acronym in English). If more than one applies, you can use the one that offers you the greatest tax benefits, says the IRS. (If you have questions about this, such as whether you should complete the form individually or together, talk to your tax advisor.)

FEDERAL TAXES

The marital status (see above) you selected on your W-4 helps your employer figure out how much to withhold from your pay for federal income taxes *. The amount listed as “Federal Tax Withholding” on your check is what your employer will send to the IRS on your behalf. Each person pays a different amount of federal tax, depending on their income.

STATE AND LOCAL TAXES

This deduction is very similar to federal taxes, except it’s money your employer sends to your state and city or county income division on your behalf, says the American Institute of CPAs (AICPA). . How much you pay in state and local taxes depends on your income and your state or municipality tax rates.

SOCIAL SECURITY OR THE FEDERAL SOCIAL SECURITY TAX ACT (FICA)

You are legally obligated to contribute to Social Security, which is the benefit program for retirees, people with disabilities, and survivors, such as a spouse or child, of social security contributors in the United States. It is listed on your check as FICA * which stands for the federal insurance contributions law. Starting in 2018, you contribute 6.2% of your gross salary (less your pre-tax health care premium deductions) to the program. Your employer contributes another 6.2% on your behalf.

MEDICARE

This is another legally required deduction that appears under the title of FICA. This amount goes to Medicare, which is the American retiree health insurance program. The mandatory contribution is 1.45% of your gross pay (less deductions for health care premiums before taxes) and your employer will have to pay the same amount on your behalf, says the IRS.

401 (K) OR 403 (B) CONTRIBUTIONS

If you can contribute to your employer’s retirement plan and signed up to have money automatically deposited into it, you will likely see this deduction on your pay stub. If you work for a tax-exempt public school or organization, and are enrolled in the retirement plan (also known as a “tax-free annuity”), you will find a 403 (b) deduction. The amount will depend on what percentage of your payment you have chosen to contribute. Many retirement tax withholdings are considered “tax deferred” – meaning that you will not pay related taxes until you actually withdraw the money from your account. As a result, these deductions can slightly reduce the amount you pay this year in federal taxes, explains the AICPA.

If your company offers to contribute the same amount of money that you contribute to your retirement plan, you will probably see it on your payroll as well. However, that amount will not be deducted from your payroll since your employer pays for it.

HEALTH INSURANCE PREMIUMS PAID BY THE EMPLOYEE

If your business pays 100% of your health insurance costs, no amount will be deducted from your paycheck. However, if you pay a portion or all of your health, dental, or vision benefits, this portion of the cost will be deducted from your paycheck, in accordance with the AICPA. Your ” premium ” is the amount you pay on a regular basis for your insurance.

OTHER DEDUCTIONS

If you are paying for other company-sponsored benefits, such as life or disability insurance, these premiums will appear as deductions on your paycheck. Depending on the plan, these costs can be deducted before or after taxes are calculated on your paycheck. If your business offers a Flexible Spending Account (FSA), you can contribute money to a health care or dependent care account before you pay taxes (which means you don’t pay taxes on these contributions), says the FSA Program. Flexible Spending Accounts *. These amounts will be deducted from your salary and included in your payroll.

ANNUAL EARNINGS TO DATE

Here’s how much gross income you’ve earned this year – excluding your current payroll, says the AICPA. However, you may not see this written down if your salary is below a certain level.

For more help understanding any of your payroll items, contact your company’s payroll or benefits office.